What Are Pro Rata Rights? A Founder’s Guide to Ownership, Follow-ons, and Investor Signals

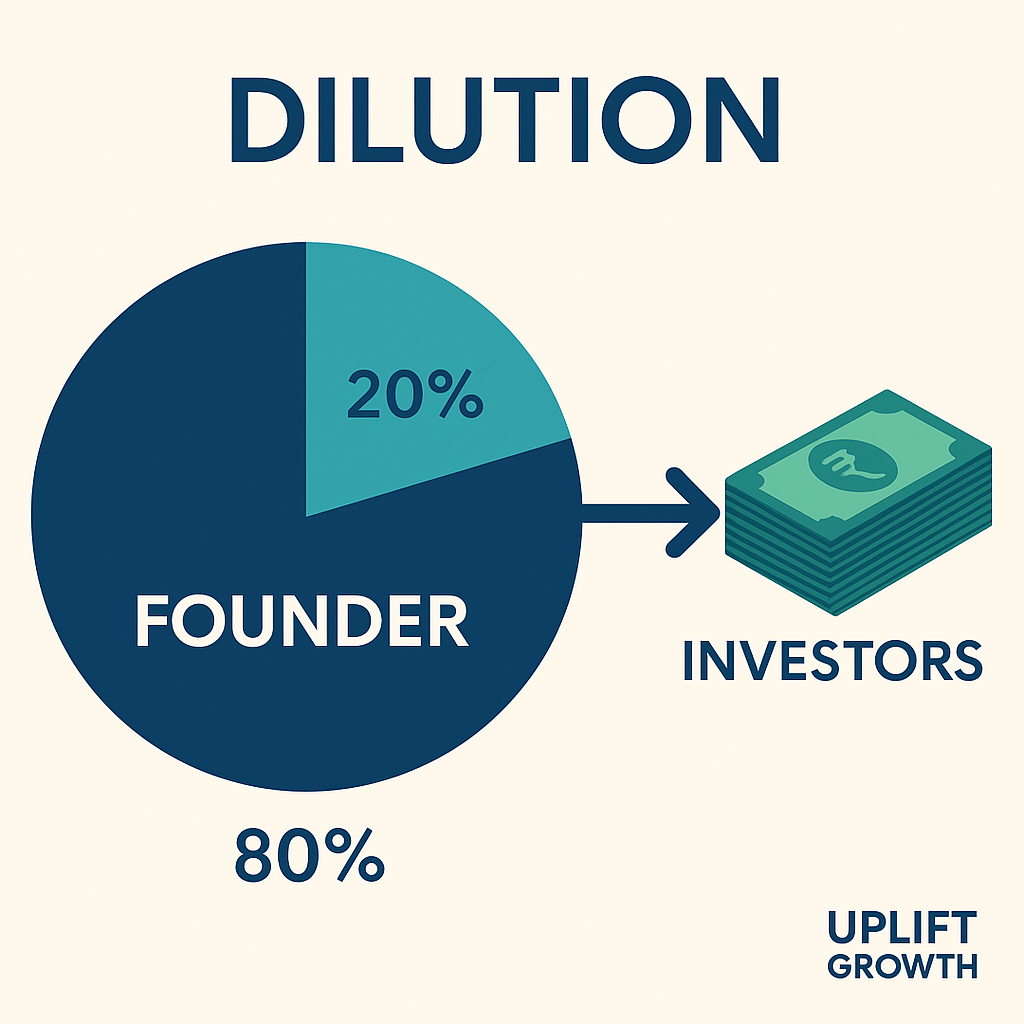

When raising capital, founders often focus on valuation, dilution, and ownership but miss the fine print on something that silently shapes future rounds: Pro Rata Rights. Understanding this clause can help you manage your cap table, avoid surprises, and signal…